Embark on a journey through the intricacies of Trip Insurance Comparison 2025: Which Policy Offers the Best Coverage?, where we unravel the mysteries behind various insurance policies and their offerings.

Delve into the nuances of coverage options, emerging trends, customer experiences, and more as we navigate the landscape of trip insurance in 2025.

Types of Trip Insurance Policies

When it comes to trip insurance policies in 2025, there are typically three main types available: basic, mid-tier, and premium. Each type offers different levels of coverage, benefits, and limitations tailored to meet the diverse needs of travelers.

Basic Trip Insurance

Basic trip insurance policies typically provide coverage for essential travel concerns such as trip cancellations, delays, and emergency medical expenses. While these policies offer a basic level of protection, they may have lower coverage limits and fewer additional benefits compared to mid-tier and premium policies.

Mid-Tier Trip Insurance

Mid-tier trip insurance policies offer a more comprehensive level of coverage than basic plans. In addition to basic coverage for trip cancellations and medical emergencies, mid-tier policies may include benefits such as coverage for lost or delayed baggage, trip interruption, and emergency evacuation.

These policies strike a balance between affordability and coverage breadth.

Premium Trip Insurance

Premium trip insurance policies provide the highest level of coverage and benefits among the three types. These policies offer extensive coverage for a wide range of travel-related issues, including cancel for any reason (CFAR) coverage, higher coverage limits for medical expenses, and enhanced benefits for trip delays and cancellations.

Premium policies are ideal for travelers seeking maximum protection and peace of mind during their trips.Overall, the type of trip insurance policy you choose should depend on factors such as your travel destination, budget, and level of risk tolerance. It's important to carefully review the coverage options, benefits, and limitations of each type of policy to select the one that best suits your individual needs and preferences.

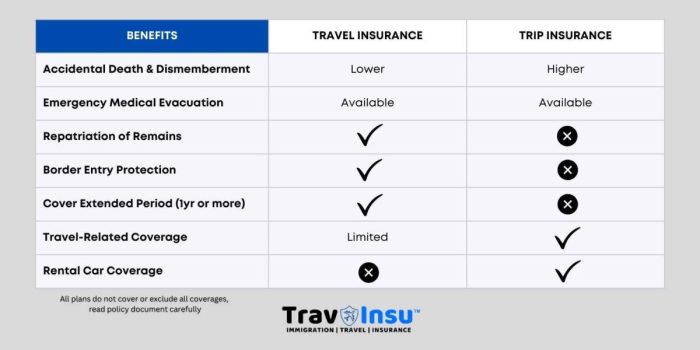

Coverage Comparison

When comparing trip insurance policies, it's essential to look at key coverage areas to ensure you're adequately protected during your travels. Different policies offer varying levels of coverage for trip cancellations, medical emergencies, lost baggage, and more. Let's break down these important aspects to help you make an informed decision.

Trip Cancellations

Trip cancellation coverage is crucial in case you need to cancel your trip due to unforeseen circumstances such as illness, natural disasters, or other emergencies. Some policies may cover 100% of your trip costs, while others may have limits or exclusions based on the reason for cancellation.

Medical Emergencies

Medical emergency coverage is essential for covering medical expenses, emergency medical evacuation, and repatriation in case you fall ill or get injured during your trip. Policies may vary in terms of coverage limits, exclusions for pre-existing conditions, and the extent of coverage for medical services.

Lost Baggage

Lost baggage coverage helps reimburse you for lost, stolen, or damaged luggage during your trip. Policies may have limits on the amount of coverage per item or per trip, as well as exclusions for valuable items like electronics or jewelry.

It's important to understand the coverage limits and exclusions to ensure your belongings are adequately protected.

Coverage Limits and Exclusions

Each trip insurance policy comes with specific coverage limits and exclusions that you need to be aware of. These limits dictate the maximum amount the insurance company will pay out for a covered claim, while exclusions specify situations or items that are not covered under the policy.

It's crucial to review these details carefully to understand the extent of your coverage and any potential gaps in protection.

Emerging Trends in Trip Insurance

In 2025, the trip insurance industry is experiencing several new trends that are reshaping the way policies are offered and utilized. Technology, personalized policies, and on-demand insurance options are playing a significant role in transforming the landscape of trip insurance.

Technology Impact

Technology is revolutionizing trip insurance offerings by streamlining the process of purchasing and managing policies. With the rise of Insurtech companies, travelers now have access to user-friendly platforms that allow them to compare policies, customize coverage, and file claims seamlessly.

Additionally, advancements in artificial intelligence and data analytics have enabled insurers to assess risks more accurately and offer more competitive pricing to customers.

Personalized Policies and On-Demand Options

The demand for personalized trip insurance policies tailored to individual needs is on the rise. Travelers are seeking flexibility in coverage options, such as customizable add-ons for specific activities or destinations. Moreover, the concept of on-demand insurance, where travelers can purchase coverage for a specific trip or duration, is gaining traction.

This allows customers to pay for insurance only when they need it, providing a cost-effective and convenient solution for occasional travelers.

Customer Reviews and Satisfaction

Customer reviews play a crucial role in helping individuals choose the right trip insurance policy. By compiling feedback from customers on their experiences with trip insurance, one can gain valuable insights into the quality of coverage and the efficiency of the claim process.

Whether it's common complaints or praises, customer reviews provide prospective buyers with a real-world perspective on what to expect from different policies.

Feedback on Coverage and Claim Processes

- Many customers highlight the ease of filing a claim and the quick response from insurance providers in processing their requests.

- Some travelers have expressed satisfaction with the comprehensive coverage offered by certain policies, citing peace of mind during their trips.

- On the other hand, common complaints include delays in claim settlements, lack of clarity in policy terms, and disputes over coverage for certain incidents.

- Customers have also mentioned instances where they felt misled by unclear language in the policy documents, leading to confusion during the claims process.

Last Point

As we conclude our exploration of Trip Insurance Comparison 2025: Which Policy Offers the Best Coverage?, remember that the right policy is not just about coverage but also about peace of mind and security during your travels.

Essential Questionnaire

What are the key coverage areas to consider in a trip insurance policy?

Key coverage areas include trip cancellations, medical emergencies, lost baggage, and other unforeseen circumstances during your travels.

How do policies in 2025 differ in terms of coverage limits and exclusions?

Policies vary in coverage limits and exclusions based on the type of policy chosen, with premium policies offering broader coverage compared to basic ones.

What are some emerging trends in the trip insurance industry for 2025?

Emerging trends include personalized policies, on-demand insurance options, and the impact of technology on insurance offerings.

How can customer reviews aid in selecting the right trip insurance policy?

Customer reviews provide insights into real experiences with trip insurance, highlighting common complaints, praises, and the efficiency of claim processes to guide individuals in choosing the most suitable policy.